by Nikola | Apr 18, 2024 | Planners, Achieve your goals

Are you feeling overwhelmed by the demands of daily life and searching for a way to achieve balance and harmony? If so, investing in a self-care planner might be the solution you’ve been looking for. This article will give you the top 10 reasons why a self-care planner can help you prioritize your well-being and make self-care a consistent part of your routine. From organizing your priorities to celebrating your wins, we will guide you through how a self-care planner can transform your life for the better.

Organize Your Priorities

One key benefit of investing in a self-care planner is the ability to organize your priorities effectively, ensuring that you allocate time and energy to what truly matters. As you streamline your tasks and goals within the planner, you create a roadmap that aligns with your values and needs, paving the way for a more balanced and harmonious life.

Actionable Tip: Use your planner as a decision-making tool, weighing the potential impact of choices on your physical, emotional, and spiritual well-being. Honour your needs and priorities, trusting your inner wisdom to guide you towards choices that align with your authentic self.

Create Space for Yourself

Taking the time to prioritize your needs and schedule moments of relaxation and rejuvenation can significantly impact your overall well-being. This intentional act of carving out space for yourself will enable you to recharge and refuel, thus leading to a more balanced and harmonious life. As you learn to prioritize self-care in your daily routine, you’ll find that creating this space for yourself benefits you and the people around you.

Actionable Tip: Dedicate a section in your planner for daily reflections on self-compassion and gratitude, acknowledging your strengths, accomplishments, and areas for growth. Practice self-care rituals that nourish your soul and replenish your spirit, fostering deep self-acceptance and resilience.

Manage Stress Effectively for Better Self-care

Now that you have created space for yourself in your busy schedule let’s explore how a self-care planner can help you effectively manage stress and find inner peace. By incorporating stress-relieving activities, such as journaling, meditation, or exercise, into your daily routine, you can proactively address the sources of stress in your life. As you become more attuned to managing stress effectively, you’ll notice a sense of calm and balance permeating your daily life, empowering you to navigate challenges with resilience and grace.

Actionable Tip: Integrate a mood tracker in your planner to identify triggers and patterns, empowering you to address sources of stress and anxiety proactively.

Cultivate Mindfulness

By cultivating mindfulness in your everyday experiences, you can fully engage with the present moment and savour the beauty of each day. This heightened awareness will not only bring a sense of peace and clarity but also allow you to set achievable goals that align with your values and priorities.

Actionable Tip: Design a wellness dashboard in your planner to record daily metrics related to your physical, emotional, and mental health. Incorporate prompts for gratitude journaling, hydration tracking, and mindful breathing exercises to foster holistic wellness habits.

Set Achievable Self-care Goals

Setting achievable goals is essential in creating a balanced and harmonious life. When you are clear about what you want to accomplish and how to get there, you will likely stay focused and motivated. By breaking down your larger objectives into smaller, manageable tasks, you can progress consistently and feel a sense of accomplishment. Learn how to set achievable goals in this post.

Actionable Tip: Utilize the goal-setting pages in your planner to outline SMART (Specific, Measurable, Achievable, Relevant, Time-bound) objectives that incorporate elements of self-care. Break down larger goals into smaller, actionable steps, and schedule regular check-ins to celebrate achievements and recalibrate as needed.

Practice Gratitude Daily

Taking time each day to reflect on the positive aspects of your life can help shift your focus from what you lack to what you have accomplished. By cultivating a mindset of gratitude, you can increase your overall sense of well-being and satisfaction. This practice strengthens your resilience in the face of challenges. Recognizing and appreciating the good in your life can help you maintain a positive outlook and stay motivated to continue investing in your self-care.

Actionable Tip: Designate a section in your planner for your gratitude practice, and experiment with different activities, layouts and prompts to discover what resonates best with you. Use colourful markers or stickers to highlight these moments visually, making them stand out amidst your daily tasks.

Monitor Your Progress

It is essential to regularly track your goals and self-care activities to monitor your progress toward achieving balance and harmony. Keeping a record of what you have accomplished and how you have taken care of yourself can provide valuable insights into your patterns and areas for improvement. A self-care planner is an excellent tool for tracking your daily routines, commitments, and achievements, allowing you to visualize your progress over time. By monitoring your journey towards well-being, you can stay accountable to yourself and make adjustments as needed to maintain a healthy balance in your life.

Actionable Tip: Design a dedicated section in your self-care planner to track your progress toward your goals and self-care activities. Set aside time each week or month to review your progress and adjust your plans accordingly. Celebrate milestones and reflect on challenges with compassion, recognizing that progress is a journey, not a destination.

Establish Healthy Self-care Habits

You are laying the groundwork for a more balanced and harmonious life by consciously setting up routines and practices that prioritize self-care. Whether incorporating daily exercise, mindfulness meditation, healthy eating, or sufficient rest, creating these habits will help you maintain your physical, mental, and emotional well-being. This foundation of self-care sets the stage for establishing boundaries to further support your well-being and create a balance in your life.

Actionable Tip: Utilize a habit tracker to monitor your progress in establishing healthy routines. Identify specific habits you want to cultivate, such as exercise, meditation, hydration, or meal planning, and set achievable targets for frequency or duration. Regularly review your tracker to assess consistency and adjust your approach to maintain sustainable habits.

Create Boundaries

Setting boundaries is an act of self-love and self-respect that can significantly impact your overall happiness and fulfillment. You create a space that nurtures your well-being and clearly defines what is acceptable and not in various aspects of your life. Boundaries can take the form of saying no to tasks that drain your energy, setting limits on how much time you spend on work versus leisure activities, or establishing boundaries with toxic relationships. By establishing healthy boundaries, you create a solid foundation for a more balanced and harmonious life.

Actionable Tip: Dedicate a section in your self-care planner to define and reinforce your boundaries in various areas of your life. Identify situations or relationships where boundaries are needed to protect your well-being and clarify your limits. Develop assertive communication strategies for expressing your boundaries respectfully and confidently. Regularly revisit and update your boundaries as your needs evolve, ensuring they align with your values and priorities.

Celebrate Your Wins

Recognize the moments when you’ve successfully established and maintained boundaries, made progress, and took time for self-care. No matter how small they may seem, these victories are significant steps towards creating a healthier and more fulfilling lifestyle. Embrace these achievements and use them as motivation to continue prioritizing your well-being. As you build on these successes, you’ll move closer to a life filled with balance, harmony, and a deep sense of self-fulfillment.

Actionable Tip: Create a “Wins Log” in your planner to celebrate and reflect on your achievements, big and small. Take time each day to acknowledge and write down successes, progress, or moments of personal growth. Use this space to express gratitude for your accomplishments and the lessons learned along the way. Review your wins regularly to strengthen your belief in your ability to overcome challenges and cultivate a positive mindset.

In Summary

Incorporating a self-care planner into your daily routine is not just a commitment to better organization and time management; it is a powerful statement of self-worth and prioritizing your well-being. You are taking essential steps toward achieving balance and harmony in your life by organizing your priorities, creating space for yourself, and managing stress effectively. Remember to cultivate mindfulness, set achievable goals, and practice gratitude daily to nourish your mind, body, and soul. Monitor your progress, establish healthy habits, create boundaries, and celebrate your wins. Embrace the journey of self-care and witness your life transform for the better. Start prioritizing yourself today – you deserve it.

Sharing is caring 😉

by Nikola | Apr 11, 2024 | Achieve your goals, Bullet Journaling

Mastering the art of budgeting is essential to building financial stability and living a fulfilling life. Understanding and implementing effective budgeting strategies can pave the way to achieving your goals. In this comprehensive guide, we’ll explore the 8 steps of the budgeting process, equipping you with the knowledge and tools to take control of your finances and build a secure future. With actionable insights and real-life examples, you’ll gain the confidence to make informed financial decisions and navigate any challenges that arise along the way.

Note: Consider consulting a certified financial planner or advisor for more personalized financial advice tailored to your unique situation.

The Power of Budgeting

Budgeting isn’t just about restricting spending; it’s a powerful tool that empowers you to make informed decisions, prioritize your financial goals, and live a life of abundance within your means. By following a structured budgeting process, you can gain clarity on your income, expenses, and savings, ultimately leading to financial freedom and peace of mind.

Understanding the 8 Steps of Budgeting Process

Step 1: Set Financial Goals

Defining your financial goals is crucial before diving into the nitty-gritty of budgeting. Whether you’re saving for a dream vacation, buying a home, or building an emergency fund, clearly articulated goals provide direction and motivation for your budgeting journey. Take some time to reflect on your aspirations and establish both short-term and long-term objectives.

Example

Your goal could be to save $417 per month for the next two years to start your emergency fund of $10,000.

Step 2: Gather Financial Information

You need to understand your current financial situation to create an accurate budget. Gather information about your income, including wages, freelance earnings, investment returns, and any other sources of revenue. Additionally, compile data on your expenses, such as rent or mortgage payments, utilities, groceries, transportation, debt repayments, and discretionary spending.

Step 3: Track Your Spending

Tracking your spending is the cornerstone of effective budgeting. By recording every expenditure, no matter how small, you can identify patterns, pinpoint areas where you’re overspending, and make necessary adjustments. Consider using budgeting apps or spreadsheets to streamline the process and gain insights into your financial habits.

Tip

I use online budgeting software called Wave Apps to categorize my expenses, which helps me visualize where my money goes each month.

Step 4: Create a Budget

With your financial goals and a clear picture of your income and expenses, it’s time to create a budget that aligns with your priorities. Allocate funds to essential categories such as housing, utilities, groceries, transportation, debt repayment, savings, and discretionary spending. Aim to balance covering necessities and saving for the future while allowing room for enjoyment and occasional splurges.

Tip

Discover different budget strategies, such as the 50/30/20 method, the zero-based budget, the pay-yourself-first budget, and more, here.

Step 5: Analyze and Adjust

Budgeting is not a set-it-and-forget-it process; it requires ongoing monitoring and adjustment. Regularly review your budget to assess your progress toward your financial goals and identify areas where you can cut back or reallocate funds. Be flexible and willing to adapt your budget as circumstances change or unexpected expenses arise.

Tip

When you realize you are overspending on a specific category, don’t panic. Brainstorm ways of reducing the expenses in that category and start implementing them step-by-step. Remember, changing your spending habits is as easy or difficult as working out. Getting used to the new routine takes time, and you might slip up occasionally. Take small, achievable steps and keep at it.

Step 6: Build an Emergency Fund

Life is full of surprises, and having an emergency fund can provide a financial safety net when the unexpected occurs. Aim to save at least three to six months’ worth of living expenses in a readily accessible account. This fund can cover unforeseen expenses such as medical emergencies, car repairs, or job loss, allowing you to weather financial storms confidently.

Tip

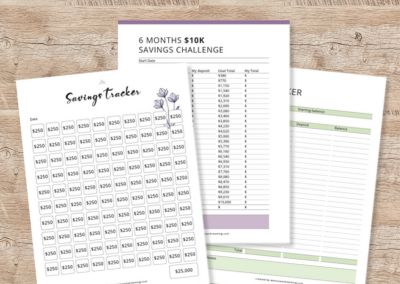

Talk with your bank or financial advisor to set up a high-yield savings account and automatic monthly contributions to gradually build your emergency fund. You can use one of these printable savings trackers to visualize your progress.

Step 7: Pay Off Debt

Debt can weigh heavily on your financial, emotional and physical health and limit your ability to achieve other goals. Prioritize paying off high-interest debt such as credit card balances or personal loans as quickly as possible. Consider implementing debt repayment strategies such as the debt snowball or debt avalanche method to accelerate your progress and become debt-free sooner.

Tip

Automate, automate, automate. Since you know your monthly expenses, you might have a better understanding and ideas of where to save money. Allocate a monthly amount towards repaying your debt and set it on autopilot. Your bank or financial advisor can help with this.

Step 8: Review and Repeat

As you progress on your budgeting journey, it’s essential to regularly review your financial goals, budget, and spending habits to ensure you’re on track to success. Celebrate your achievements, learn from setbacks, and stay committed to your long-term financial well-being. Remember, budgeting is a lifelong skill that evolves with your circumstances and aspirations.

Tip

In your calendar, set aside time, either weekly, bi-weekly, or monthly, to track and review your budget. Thirty minutes to one hour should be enough to keep you on track. Reviewing your progress and discovering patterns or challenges will keep you motivated toward your financial goals.

Empower Your Financial Future

Mastering the budgeting process is not only about managing your money; it’s about taking control of your future and creating the life you desire. By following these eight steps and incorporating them into your daily routine, you can cultivate healthy financial habits, achieve your goals, and experience true financial freedom. Remember, the journey to financial success begins with a single step – take the first step today and embark on your path to a brighter tomorrow.

Additional Resources:

Invest in your financial future today and reap the rewards tomorrow. Happy budgeting!

by Nikola | Apr 3, 2024 | Achieve your goals

Are you tired of setting the same old goals month after month, only to fall short of achieving them? It’s time to break free from the traditional approach to goal-setting and try something different. This article will explore how you can set goals differently and break the mould by reflecting on what matters most, defining success on your terms, creating a personalized action plan, and staying accountable. By following these steps, you can achieve goals in a way that truly resonates with you and take your success to new heights. Are you ready to shake things up and gain a fresh perspective on goal-setting? Let’s dive in and discover a new way to set and achieve your goals.

Reflect on What Matters Most

Take a moment to think about what truly brings you fulfillment and satisfaction. Understanding what is most important to you can ensure your goals align with your values and priorities. This reflection will guide you in setting meaningful goals that resonate with your inner self.

Define Your Definition of Success

As you reflect on what matters most, defining your definition of success is essential. Success is not a one-size-fits-all concept; it varies from person to person. Think about what success looks like—achieving a specific goal, feeling contentment in your daily life, or positively impacting others. By defining what success means, you can set significant and fulfilling goals.

Create a Personalized Action Plan

Understanding your unique definition of success will guide you in creating a personalized action plan that aligns with your values and aspirations, setting you up for a successful month ahead. Outline actionable steps and milestones that align with your vision. Break down larger goals into smaller, manageable tasks, ensuring they are specific, measurable, achievable, relevant, and time-bound (SMART).

Discover more

Not sure what your goals are? Discover the goals that fuel your passions with these ultimate goal-setting worksheets.

Stay Accountable and Adjust as Needed

Reflecting on what matters most and defining your version of success is just the beginning. Staying accountable and adjusting as needed is crucial once you have set your goals and created an action plan. Accountability will help you stay focused and motivated, ensuring you progress toward achieving your goals. Regularly review your goals and action plan, tracking your progress and making adjustments as necessary. If you find that certain goals are no longer relevant or need to be modified, don’t be afraid to adapt and make changes. This way, you can set yourself up for success and ensure you are on the right path to reaching your goals. Remember, it’s okay to modify your goals as you progress and learn more about what works best for you. By staying accountable and making necessary adjustments, you will be well-equipped to truly break the mould in setting and achieving your goals.

Read more

Organize, Create, Thrive: Your Complete Guide to Choosing the Ideal Goal Planner

Summary

As you embark on this new month, remember to approach your goals with a fresh perspective. By reflecting on what truly matters to you, defining success on your terms, creating a personalized action plan, and holding yourself accountable, you have the power to break free from traditional goal-setting methods. Embrace this opportunity to set goals differently and pave the way for a more fulfilling and successful journey. Remember, it’s not about conforming to the norm but creating your path to success. So, challenge the mould, and watch as you achieve new heights you never thought possible. Start today and make this month your best one yet.

by Nikola | Mar 28, 2024 | Achieve your goals

Are you struggling to keep track of your expenses and make the most out of your finances? Does the word budgeting give you shivers like the word dieting? Do you wish you could take control and start making smarter decisions with your money? If so, you’re not alone. According to a survey, 65% of households do not have enough money to cover six weeks’ worth of expenses, and over 70% of Americans live paycheck to paycheck. Look no further than a free expense tracker on Google Sheets. In this ultimate guide, we will show you how to harness the power of technology to master your finances and ultimately achieve financial freedom. From setting up your tracker to analyzing your expenses, get ready to transform your budgeting game and take charge of your financial future. Let’s dive in and start your journey to economic empowerment.

Balancing Act of Budgeting

Reducing financial stress and increasing your financial stability requires balancing your income and expenses. For many, however, the word “budget” carries connotations of restriction and sacrifice, evoking feelings of limitation rather than empowerment. Some may perceive budgeting as a rigid and confining practice that stifles spontaneity and inhibits their ability to enjoy life to the fullest. Additionally, individuals often struggle with budgeting due to a lack of understanding or effective strategies, leading to frustration and a sense of futility. As a result, they may dismiss budgeting as ineffective or impractical for their lifestyle, overlooking its potential to provide clarity, control, and, ultimately, financial freedom.

Reframing it as a tool for empowerment rather than restriction is essential to overcome the aversion to budgeting. By emphasizing flexibility, personalization, and achievable goals, individuals can adopt a mindset that views budgeting as a means to prioritize spending in alignment with their values and aspirations. Providing user-friendly resources, such as customizable expense trackers in platforms like Google Sheets, can further facilitate engagement and success in budgeting.

Discover more

Aside from the convenience of digital tracking, if you love a paper-and-pen approach to monitoring your savings, check out this free printable savings tracker in this comprehensive guide.

Let’s delve into the fundamental principles that will guide you in mastering the balancing act of budgeting.

Setting Up Your Expense Tracker on Google Sheets

To set up your expense tracker on Google Sheets, start by creating a new spreadsheet and label the columns with categories such as date, description, amount, and category. Input your income sources and recurring expenses to understand your financial standing clearly. By establishing this foundation, you can seamlessly transition into tracking your expenses regularly and effectively.

Tracking Your Expenses

To stay on track and motivated with your budget, it is crucial to make it a habit to record your expenses regularly. This will ensure you have an accurate and up-to-date view of where your money is going and avoid the overwhelming hassle of backtracking for a whole month. By staying consistent with your tracking, you’ll be able to identify patterns in your spending habits and make adjustments as needed. This practice will set the foundation for creating a budget plan that works for you, helping you take control of your finances and reach your goals.

Creating a Budget Plan That Works for You

Creating a budget plan that works for you involves understanding your spending habits and financial goals. Frequently review your tracked expenses to see where your money goes each month. Identify areas where you may be overspending or where you can cut back to align with your financial objectives. Creating a realistic budget based on income and expenses allows you to set yourself up for economic success.

This personalized approach will help you make informed decisions about your spending and savings, ultimately leading you to achieve your financial goals. Analyzing your expenses and making small adjustments to your spending habits can significantly impact your overall financial picture.

For example, if you notice that you consistently spend more than you earn on dining out, this could be an area you should cut back on to realign with your financial goals. This proactive approach will help you stay on track toward achieving your financial goals and creating a more secure future.

Mastering your finances with a free expense tracker on Google Sheets is the key to taking control of your budget and achieving financial freedom. By balancing your expenses, setting up a tracker, tracking daily expenses, creating a budget plan, and analyzing your spending patterns, you can make informed decisions to reach your financial goals. Start tracking your expenses today and watch your financial future unfold. Remember, every penny counts towards your path to economic success. Start now and see the difference it makes in your life.

Get Your Free Expense Tracker

With an expense tracker in Google Sheets by your side, you’re not just managing your finances — you’re taking control of your future. Let’s thrive together on the path to financial freedom!

by Nikola | Mar 21, 2024 | Achieve your goals

Welcome to the ultimate guide on utilizing a free printable savings tracker to empower your financial journey. Whether you’re a seasoned planner enthusiast or just starting to explore the world of personal finance, this guide is crafted with you in mind. We’ll delve into the importance of savings tracking, provide actionable tips for effective goal-setting, and showcase free printable trackers designed to elevate your financial management experience.

Why Tracking Your Savings Matters

Tracking your progress with a free printable savings tracker is not merely about monitoring numbers; it’s a strategic approach to achieving your financial aspirations. Here’s why it’s crucial:

- Clarity and Awareness: Documenting your savings progress helps you gain a clear understanding of your financial habits and where adjustments may be necessary.

- Goal Reinforcement: Visualizing your savings goals through trackers reinforces your commitment and motivates you to stay on track, even when challenges arise.

- Empowerment and Control: Taking control of your finances instills a sense of empowerment, enabling you to make informed decisions and pursue your dreams confidently.

Read more

Discover how trackers help you see the bigger picture and keep you motivated. It’s all about the power of visualization and staying focused on your long-term goals.

Setting Effective Savings Goals

Before diving into savings tracking, it’s essential to establish SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals. Here’s a step-by-step approach:

- Identify Your Objectives: Determine what you’re saving for, whether it’s an emergency fund, a vacation, debt repayment, or a future investment.

- Quantify Your Goals: Assign a specific monetary value to each objective and set a realistic timeframe for achieving them.

- Break It Down: Divide your overarching goals into smaller, manageable milestones. This makes your progress more tangible and fosters a sense of accomplishment.

The Power of Free Printable Savings Trackers

Now, let’s explore how free printable savings trackers can revolutionize your financial journey:

- Visual Representation: Printable trackers offer a visual representation of your savings progress, making it easier to comprehend and stay motivated.

- Customization: With many designs available, you can choose a tracker that resonates with your aesthetic preferences and personal style, enhancing your planning experience.

- Accessibility and Affordability: Free printable trackers eliminate the need for costly software or subscriptions, ensuring accessibility to individuals from all financial backgrounds.

Choosing the Right Tracker for You

Selecting the perfect savings tracker is crucial for maintaining consistency and engagement. Consider the following factors:

- Format: Determine whether you prefer a digital tracker for convenience or a printable version for a tactile experience.

- Design: Look for a design that aligns with your visual preferences and offers practical features such as categorization for different savings goals.

- Functionality: Assess the tracker’s usability and whether it provides adequate space for recording transactions, reflections, and adjustments.

Introducing Free Printable Savings Trackers

To kickstart your savings journey, we’ve curated a collection of free printable savings trackers available in three different paper formats (Letter size, DIN A4 & DIN A5).

Empower Your Financial Future

Incorporating free printable savings trackers into your financial routine is a game-changer. These trackers pave the way for a brighter economic future by fostering awareness, motivation, and accountability. Remember, the journey to financial wellness is a marathon, not a sprint. Stay committed, celebrate your victories, and embrace the transformative power of savings tracking.

by Nikola | Mar 14, 2024 | Achieve your goals

Welcome to the ultimate guide on “How to Set Goals You Can Achieve.” Whether you’re a creative professional, entrepreneur, student, or someone passionate about personal development, mastering the art of goal-setting is crucial for success. This comprehensive guide will delve into the steps, tips, and strategies to help you set and achieve your goals that align with your aspirations, values, and lifestyle. From journaling to planners and printables, we’ll explore how to harness these tools to elevate your goal-setting journey. By the end, you’ll have the tools and insights to craft meaningful goals and see them come to fruition. Let’s embark on this journey together, shall we?

How to Set Goals Step 1: Reflect

Before diving into the nitty-gritty of goal-setting, take a moment to reflect on your values, passions, and long-term aspirations. Set aside a quiet moment with your journal or planner and ask yourself: What do I truly want to achieve? What areas of my life do I want to improve? Understanding your core values will provide a solid foundation for setting meaningful and fulfilling goals. The Ultimate Goal Setting Worksheet can help you get started.

How to Set Goals Step 2: Define

Once you’ve clarified your values, it’s time to translate them into actionable goals. To structure your goals effectively, utilize the SMART criteria—specific, measurable, achievable, relevant, and time-bound. For example, instead of setting a vague goal like “get in shape,” aim for something more specific and measurable, such as “run a 5K race in six months.”

How to Set Goals Step 3: Tasks

Large goals can feel overwhelming, but breaking them into smaller, manageable tasks makes them more attainable. With your SMART objectives in place, it’s time to create an action plan to bring your goals to life. Create a roadmap in your planner or journal by outlining the specific actions you need to take to reach each goal. This approach simplifies the process and provides a clear path forward.

How to Set Goals Step 4: Tools

Equip yourself with the right tools and resources to stay organized and on track. Explore various planners, journals, and printables that resonate with your style and preferences. Whether you prefer digital or analog methods, countless options are available to help you stay focused and motivated.

How to Set Goals Step 5: Adapt

Flexibility is critical when it comes to goal-setting. Life is unpredictable, and obstacles may require you to pivot or adjust your plans. Everyone falls off the metaphorical bandwagon once in a while, or your goals simply change. Embrace change and be willing to adjust your goals and strategies as needed. Remember, progress is not always linear, but every step forward brings you closer to your ultimate destination.

How to Set Goals Step 6: Celebrate

As you progress towards your goals, take the time to celebrate your achievements, no matter how small they may seem. Recognize your effort and dedication in your journey, and acknowledge your progress. Use your journal or planner to capture these moments of success and reflect on how far you’ve come. Celebrating your achievements will fuel your motivation and inspire you to keep pushing forward.

Tips for Success

- Set Priorities: Focus on a few key goals to avoid feeling overwhelmed.

- Celebrate Progress: Acknowledge and celebrate your achievements, no matter how small.

- Seek Support: Surround yourself with like-minded individuals who can offer guidance and encouragement.

- Practice Self-Compassion: Be kind to yourself and recognize that setbacks are a natural part of the journey.

- Stay Consistent: Establish daily habits and routines that align with your goals to maintain momentum and consistency.

Read more

Check out Psychology Today’s 5 Essential Tips for Goal Setting

In Summary

Congratulations! You’ve embarked on a transformative journey towards setting and achieving goals that resonate with your values and aspirations. By following the steps outlined in this guide and incorporating the tips for success, you’re well-equipped to navigate the path to success with confidence and clarity. Remember, goal-setting is not just about reaching the destination; it’s about embracing the journey and the growth it brings. Here’s to a future filled with purpose, fulfillment, and endless possibilities. Keep striving, keep dreaming, and keep achieving!

Ready to take your goal-setting to the next level?

Download our ultimate goal-setting worksheet now and turn your dreams into reality!