Are you struggling to keep track of your expenses and make the most out of your finances? Does the word budgeting give you shivers like the word dieting? Do you wish you could take control and start making smarter decisions with your money? If so, you’re not alone. According to a survey, 65% of households do not have enough money to cover six weeks’ worth of expenses, and over 70% of Americans live paycheck to paycheck. Look no further than a free expense tracker on Google Sheets. In this ultimate guide, we will show you how to harness the power of technology to master your finances and ultimately achieve financial freedom. From setting up your tracker to analyzing your expenses, get ready to transform your budgeting game and take charge of your financial future. Let’s dive in and start your journey to economic empowerment.

![]()

Balancing Act of Budgeting

Reducing financial stress and increasing your financial stability requires balancing your income and expenses. For many, however, the word “budget” carries connotations of restriction and sacrifice, evoking feelings of limitation rather than empowerment. Some may perceive budgeting as a rigid and confining practice that stifles spontaneity and inhibits their ability to enjoy life to the fullest. Additionally, individuals often struggle with budgeting due to a lack of understanding or effective strategies, leading to frustration and a sense of futility. As a result, they may dismiss budgeting as ineffective or impractical for their lifestyle, overlooking its potential to provide clarity, control, and, ultimately, financial freedom.

Reframing it as a tool for empowerment rather than restriction is essential to overcome the aversion to budgeting. By emphasizing flexibility, personalization, and achievable goals, individuals can adopt a mindset that views budgeting as a means to prioritize spending in alignment with their values and aspirations. Providing user-friendly resources, such as customizable expense trackers in platforms like Google Sheets, can further facilitate engagement and success in budgeting.

Discover more

Aside from the convenience of digital tracking, if you love a paper-and-pen approach to monitoring your savings, check out this free printable savings tracker in this comprehensive guide.

Let’s delve into the fundamental principles that will guide you in mastering the balancing act of budgeting.

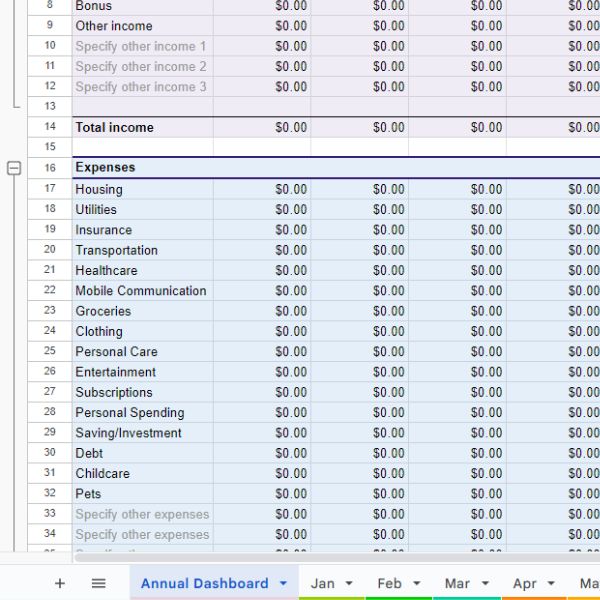

Setting Up Your Expense Tracker on Google Sheets

To set up your expense tracker on Google Sheets, start by creating a new spreadsheet and label the columns with categories such as date, description, amount, and category. Input your income sources and recurring expenses to understand your financial standing clearly. By establishing this foundation, you can seamlessly transition into tracking your expenses regularly and effectively.

![]()

Tracking Your Expenses

To stay on track and motivated with your budget, it is crucial to make it a habit to record your expenses regularly. This will ensure you have an accurate and up-to-date view of where your money is going and avoid the overwhelming hassle of backtracking for a whole month. By staying consistent with your tracking, you’ll be able to identify patterns in your spending habits and make adjustments as needed. This practice will set the foundation for creating a budget plan that works for you, helping you take control of your finances and reach your goals.

Creating a Budget Plan That Works for You

Creating a budget plan that works for you involves understanding your spending habits and financial goals. Frequently review your tracked expenses to see where your money goes each month. Identify areas where you may be overspending or where you can cut back to align with your financial objectives. Creating a realistic budget based on income and expenses allows you to set yourself up for economic success.

This personalized approach will help you make informed decisions about your spending and savings, ultimately leading you to achieve your financial goals. Analyzing your expenses and making small adjustments to your spending habits can significantly impact your overall financial picture.

For example, if you notice that you consistently spend more than you earn on dining out, this could be an area you should cut back on to realign with your financial goals. This proactive approach will help you stay on track toward achieving your financial goals and creating a more secure future.

Mastering your finances with a free expense tracker on Google Sheets is the key to taking control of your budget and achieving financial freedom. By balancing your expenses, setting up a tracker, tracking daily expenses, creating a budget plan, and analyzing your spending patterns, you can make informed decisions to reach your financial goals. Start tracking your expenses today and watch your financial future unfold. Remember, every penny counts towards your path to economic success. Start now and see the difference it makes in your life.

Get Your Free Expense Tracker

With an expense tracker in Google Sheets by your side, you’re not just managing your finances — you’re taking control of your future. Let’s thrive together on the path to financial freedom!